- Jim said..."Congratulations on your recent (very timely) forecasts Raj, in particular your call for a Down day on Tues 02-27. Great timing. I am a long term subscriber to your service and highly recommend it. Thank you as always for sharing your work. Jim P"

This is a stockmarket site for both intraday and swingtraders, trading the SP emini,ETF's like QLD, SSO, etc. Various Timing techniques and Cycles are researched. Precise Timing is everything. Both Intraday and daily Change in Trend (CIT) Times are calculated through several unique timing methods that are often exact or off by mostly +/- 5-10 minutes for intraday times and +/-1 day for the daily CITs. All the different Cycles in the SP 500 markets are discussed.

Wednesday, February 28, 2018

Jim said...

Tuesday, February 27, 2018

The MC remains ontrack...

The MC remains ontrack with 2/22L, 2/26H and today's (2/27) strong down day...

Friday, February 23, 2018

Tuesday, February 20, 2018

Time CIt to watch today 2/20

The 11.40-12.45 hourly time CIT, centered on 12.00 pm Eastern today could be an important time to watch.

Thursday, February 15, 2018

The dominant Master Cycle: Review & Forecast

Forecast made on Feb 5 on the T&C public blog: "If this Bitcoin SPX Analog cycle remains active, we are generally lower into 2/9 Crash Lows, then Up into 2/15-16 SPX Highs. The BIG Question is how long will this correlation last??"

Forecast from Feb 5: "The Master Cycles now looking for 2/6H and another decline into 2/9 major Low, then rally into 2/15-16H. Both the MC and the bitcoin Analog are looking for a 2/9L and 2/15-16H"

Actual: We made a 2/7H, declined sharply to 2/9 major Lows and have rallied sharply into 2/15H so far.

Forecast from Feb 5: "The Master Cycles now looking for 2/6H and another decline into 2/9 major Low, then rally into 2/15-16H. Both the MC and the bitcoin Analog are looking for a 2/9L and 2/15-16H"

Actual: We made a 2/7H, declined sharply to 2/9 major Lows and have rallied sharply into 2/15H so far.

A Master Cycle (MC) is an actual historic cycle with a proprietary numerology, that repeats exactly day by day and is off at most 1 day. The Master Cycle has to have at least 3-5 direct recent "hits" to become dominant and when it does, it becomes the most powerful predictive tool anyone can have as it is worth its price in Gold as it can bring Dawn of Fortune in a relative short time. The Master Cycle can last for weeks and months or it can stop working at anytime, so Caveat emptor.

I have not found a Master Cycle that has been working this good in many years, so enjoy it while it last.

I have not found a Master Cycle that has been working this good in many years, so enjoy it while it last.

The Bitcoin Analogy was made public on 2/5, because The Master Cycle, which has precedent above all other cycles, said the same thing, from 2/9L we rally into 2/15-16H, but the MC is suggesting a different path after 2/15-16H.

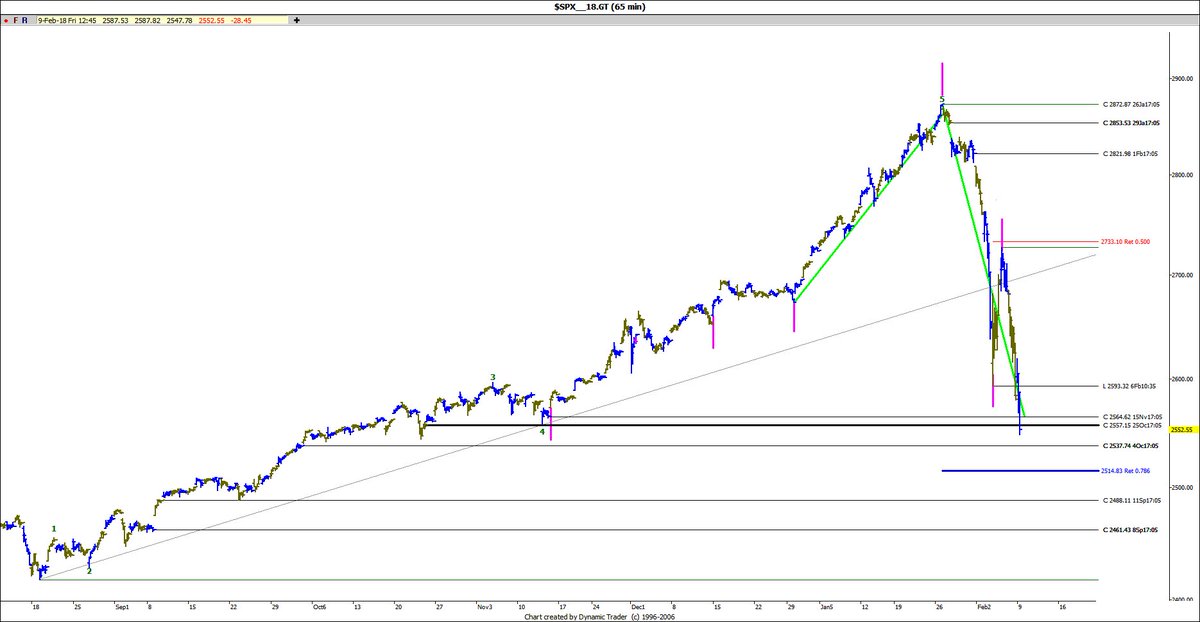

The dominant Master Cycle (MC) in Trading days (TD) currently has 8 hits (pink vertical lines on chart above):

1. 11/15/17L-1

2. 12/15/17L-1

3. 12/29/17L,

4. 1/26/18HH

5. crash into 2/5/18L+1.

6. 2/6/18H+1.

7. 2/9/18L

8. 2/16/18H

What's next: The Master Cycle is expecting a short term 2/16H+/-1.

Please note: If you have been missing my free forecasts and Updates, you need to follow:

http://timeandcycles.blogspot.com/ and or

https://twitter.com/TimeandCycles

Email: timeandcycles@gmail.com

Wednesday, February 14, 2018

Looking good Billy Ray!

https://www.youtube.com/watch?v=XtKydtoLucc

http://timeandcycles.blogspot.com/2018/02/the-bitcoin-to-spx-41-cd-cycle-analog.html

"If this Bitcoin SPX Analog cycle remains active, we are generally lower into 2/9 Crash Lows, then Up into 2/15-16 SPX Highs. The BIG Question is how long will this correlation last?? "

Btw, I only liked this Bitcoin Analogy, because The Master Cycle, which has precedent above all other cycles, said the same thing, from 2/9L we rally into 2/15-16H, but it is suggesting a different path after 2/15-16H.

http://timeandcycles.blogspot.com/2018/02/the-bitcoin-to-spx-41-cd-cycle-analog.html

"If this Bitcoin SPX Analog cycle remains active, we are generally lower into 2/9 Crash Lows, then Up into 2/15-16 SPX Highs. The BIG Question is how long will this correlation last?? "

Btw, I only liked this Bitcoin Analogy, because The Master Cycle, which has precedent above all other cycles, said the same thing, from 2/9L we rally into 2/15-16H, but it is suggesting a different path after 2/15-16H.

Saturday, February 10, 2018

The 375 TD and 375 Lunar Month Cycle

Courtesy of Tom Mahoney 1422 Panic Cycle:

9/1/98L-1422-7/24/02L-1421-6/15/06L-1422-5/6/10L-3/28/14L (miss)- Saturday 2/17/18 (2/16-20) (Monday 2/19 is President's Holiday)

5 X 1422: 1998: 2/5H, 2/11H, crash 2/18/18L

4 X 1422: 2002: 2/2H, crash 2/18/18L

3 x 1422: 2006: 2/2H, crash 2/18/18L

2 X 1422: 2010: 2/7H =4/26/10H, Flash Crash 5/6/10L = 2/17/18L

I looked a little closer at the 1422 Calendar Days (CD) Crash Cycle (Blue vertical lines in chart below) in Trading Days (TD) and it shows up as a 976 TD Cycle suggesting a 1/26/18 major High instead of a 2/17/18 crash Low (it could be either way, go figure!):

9/1/98L (-1 TD), 7/24/02L, 6/14/06L (+4 TD), 4/26/10H and 1/26/18H

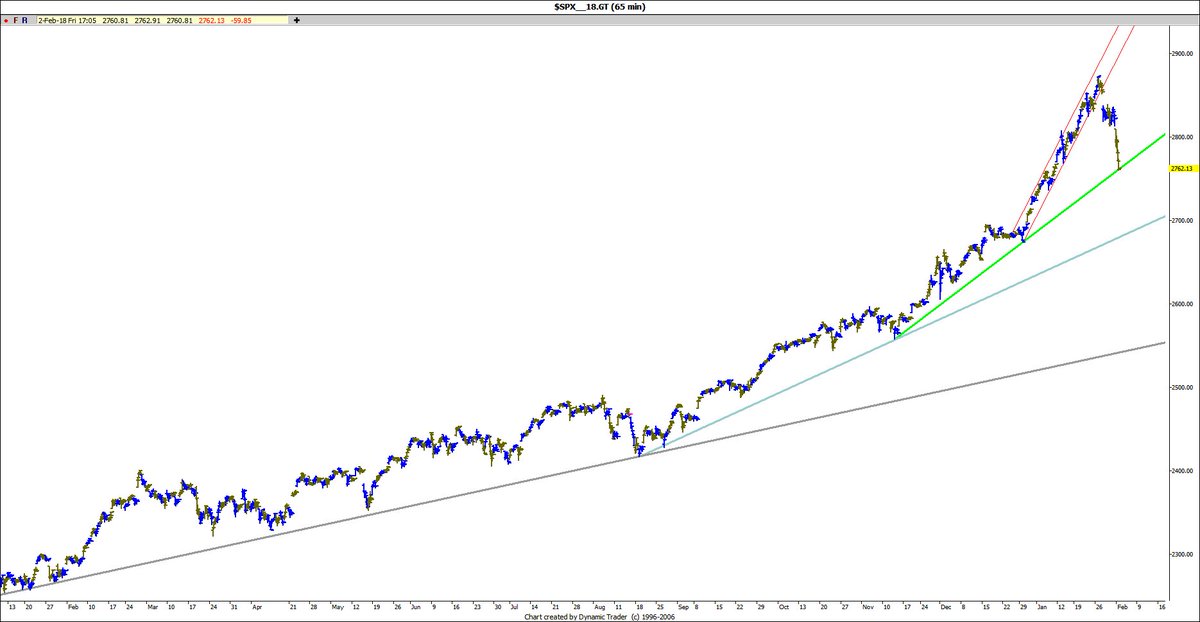

The 375 TD Cycle started 18 years ago from 3/24/00H and is next due 2/12+/-

2/12: 9/21/01L + 11 X375 TD = 2/12/18, 2/15/16H + 1 X 375 TD = 2/12/18

2/13: 3/6/09L + 6 X 375 TD = 2250 TD = 2/13/18

2/14: 3/24/00H+ 12 X 375 TD = 4500 TD = 2/14/18

Here is a "just for fun" analog for Monday 2/13

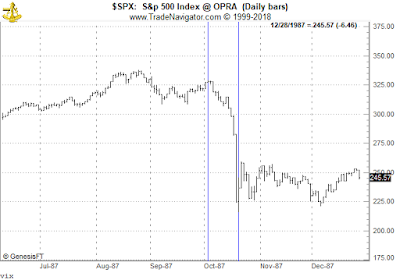

The speculative 1987 Analog is the 375 Lunar Month Cycle:

10/07/87 Lunar Eclipse +375 LM = 1/31/18 Lunar Eclipse

Friday 10/2/87H = Friday 1/26/18H

10/12/87L= 2/5/18L+1

10/13/87H = 2/6/87H+1

Monday 10/19/87 Crash day = Monday 2/12/18 Crash day?

10/20/87L= 2/13/18L = New Moon -2

This cycle is just for fun as we do not have enough data, but the above 3 dates were all direct "hits".

This cycle is just for fun as we do not have enough data, but the above 3 dates were all direct "hits".

2/13/18 is 375 Lunar Months from 10/20/87 Crash Low.

2/13/18 is 1309 (Half of Fibonacci 2618) Lunar Months from the 4/14/1912 Titanic Disaster

2/12/18 is 6000 CD from 9/11/01 Terror attack

2/13/18 is the New Moon -2 CD, associated with infamous crash Lows, including 4/14/1912 Titanic Crash (sinking), 10/29/29L, 10/20/87L and 10/28/97L.

2/13 is "Maha ShivaRatri" in the Vedic Lunar Calendar, the Natural Laws governing Silence, Peace & destruction of Ignorance and thereby causing growth and Evolution.

We were expecting a 2/9-12 Low (see previous post) and there is a real possibility the Low is already in at the 2/9L, as we touched long term channel support, but Monday 2/12 needs to confirm this or not, we will find out soon enough.

Friday, February 9, 2018

Day 2

"Next it is looking for 3 TD down (from 2/7H), that brings us to Monday 2/12 (instead of 2/9)" Pink vertical lines are Master Cycle "hits"

Today is Day 2, still looking for a 2/9-12 Low

0 replies0 retweets0 likes

Intraday cycle 2/9/18

The intraday cycle is a High am to Low pm day (or Inverse)

A High am to Low pm day means we see 1st hour High, a midday Low and last hour Low.

A Low am to High pm day means we see a 1st hour Low, midday High and last hour High.

A High am to Low pm day means we see 1st hour High, a midday Low and last hour Low.

A Low am to High pm day means we see a 1st hour Low, midday High and last hour High.

Thursday, February 8, 2018

Wednesday, February 7, 2018

Only a Fool...

The markets are like a slippery eel, if you are not very very precise, you would have missed the recent sharp 100 SP+ declines and rallies. Being off by 1-11/4 Trading days is not good enough and makes a world a difference and makes one look like a fool, so we got to do better than that.

To improve/refine the current performance, we need to count precise trading days to get more accuracy. The Master Cycle (MC) and Bitcoin Cycle suggested:

1. 6 TD down from 1/26H, which was then 2/5L (The low was at the Open 2/6L)

2. A one day wonder sharp rally into 2/6H (The High was 1/4 day later at 2/7H at 11.15H)

3. Next it is looking for 3 TD down, that brings us to Monday 2/12 (instead of 2/9), etc...

Only a fool makes these kind of precise bold predictions public.

Only a fool challenges the market Gods to prove him wrong by a continued rally the next few days to higher Highs, making the MC and Bitcoin Cycle DOA (Dead on arrival), but the good news is we will know in the next day or so...

To improve/refine the current performance, we need to count precise trading days to get more accuracy. The Master Cycle (MC) and Bitcoin Cycle suggested:

1. 6 TD down from 1/26H, which was then 2/5L (The low was at the Open 2/6L)

2. A one day wonder sharp rally into 2/6H (The High was 1/4 day later at 2/7H at 11.15H)

3. Next it is looking for 3 TD down, that brings us to Monday 2/12 (instead of 2/9), etc...

Only a fool makes these kind of precise bold predictions public.

Only a fool challenges the market Gods to prove him wrong by a continued rally the next few days to higher Highs, making the MC and Bitcoin Cycle DOA (Dead on arrival), but the good news is we will know in the next day or so...

Please note: If you have been missing my free forecasts and Updates, you need to follow:

http://timeandcycles.blogspot.com/ and or

https://twitter.com/TimeandCycles

Tuesday, February 6, 2018

What a Difference one day makes!

The forecasted one day rally that was made for Monday, came today, one day later, what a difference one day makes!!

See today's forecast for a rally today versus actual

The daily cycles all came a day later as well, ie 2/5L and one day rally 2/6H.

The Bitcoin Analog Cycle suggests we should see a Hard retest of today's Lows by 2/9 Low and then rally into 2/15H in Option Expiration week.

See today's forecast for a rally today versus actual

The daily cycles all came a day later as well, ie 2/5L and one day rally 2/6H.

The Bitcoin Analog Cycle suggests we should see a Hard retest of today's Lows by 2/9 Low and then rally into 2/15H in Option Expiration week.

Monday, February 5, 2018

The Bitcoin to SPX Biblical 40-41 CD Cycle Analog

What is so special about 55 CD?

9/03/29H to 10/28/29 Crash day = 55 CD

8/25/87H to 10/19/87 Crash day = 55 CD

The infamous 55 CD from Bitcoin 12/16/17H is 2/09/18 Crash Day?

The infamous 55 CD from SPX 01/26/18H is 03/22/18 Crash Day?

9/03/29H to 10/28/29 Crash day = 55 CD

8/25/87H to 10/19/87 Crash day = 55 CD

The infamous 55 CD from Bitcoin 12/16/17H is 2/09/18 Crash Day?

The infamous 55 CD from SPX 01/26/18H is 03/22/18 Crash Day?

The Bitcoin to SPX biblical 40-41 CD Cycle Analog

Bitcoin Low to High 07/15/17L - 12/16/17H = 155 CD

SPX500 Low to High 08/21/17L - 01/26/18H =

158 CD

Bitcoin Low to High 9/14/17L - 12/16/17H = 95 CD

SPX500 Low to High 10/25/17L - 1/26/18H = 93 CD

Bitcoin Low to High 11/11/17L -12/16/17H =35 CD

SPX500 Low to High 12/22/17L - 1/27/18H = 35 CD

1. Bitcoin High to Low 12/16/17L + 7 CD = 12/23/17L

1. SPX500 High to Low 1/26/18H + 7 CD = 02/02/18L

2. Bitcoin

High to High 12/16/17H + 10 CD = 12/26/17H

2. SPX500 High to High 01/26/18H + 10 CD = 02/05/18H

3. Bitcoin High to Lows 12/16/17H

+13 CD = 12/29/17L

3. SPX500 High to Lows 1/26/18H + 13 CD = 02/08/18L

4. Bitcoin

High to High 12/16/17H + 20 CD = 01/05/08H

4. SPX500 High to High 01/26/18H + 20 CD = 02/15/18H

5. Bitcoin

High to Lows 12/16/17H + 31 CD = 01/16/18L

5. SPX500 High to Lows 1/26/18H + 31 CD = 02/26/18L

Bitcoin Highs and Lows: 1/19H, 1/22L, 1/27H,

2/1L, 2/2H, future: 2/9LL

Bitcoin High and Lows + 40-41 CD = SPX High and Lows

Example Bitcoin 12/16/17H+41 = SPX 1/26/18H, etc.

The Bitcoin to SPX 40-41 CD Cycle Analog suggests: 1/26/18HH, 2/2L, 2/5H, 2/8 lower Lows, Up to 2/15H, crash into 2/26L, 3/1H,

3/4L, 3/9H, 3/14L, 3/15H, 3/22LLL (= 55 CD +1/26HH).

Currently, the analog is off by + 1 day, ie 2/2 Low is +1 Day = 2/5L and 2/5H = +1 day = 2/6H, etc.

If this Bitcoin SPX Analog cycle remains active, we are generally lower into 2/9 Crash Lows, then Up into 2/15-16 SPX Highs. The BIG Question is how long will this correlation last??

If this Bitcoin SPX Analog cycle remains active, we are generally lower into 2/9 Crash Lows, then Up into 2/15-16 SPX Highs. The BIG Question is how long will this correlation last??

Friday, February 2, 2018

Rally Monday

Gap Up Monday? perhaps, but even a spillover decline Monday should reverse into a rally...

Subscribe to:

Comments (Atom)