The following short term forecast is speculative and for Entertainment purposes only, do trade at your own risk.

All trends are Up as we recently bottomed at the 49 Trading Day (TD) Cycle of Lows (see Emini SP chart below), we are generally higher and surprises will be to the upside.

We have rallied into Friday 12/10 SPX proprietary Geometric* time CIT (change in Trend) and into Monday 12/13 Apple Geometric time CIT, suggesting a short term 12/13 swing High is being made. We need a reversal and close lower to confirm a 12/13 swing High is in.

The intraday cycles are suggesting a possible spillover rally Monday in the 1st minutes, before we reverse lower.

Intraday CIT times to watch, all /-5-10 mins are: 11.00, 11.30 and 1.10-15 pm Eastern.

Speculative Intraday Times and Cycles Bias: The current bias (but that can change quickly) is 11.00 will be a Low, 11.30 will be a High and 1.10-15 pm will be a Low. So if we get an opening 9.40H+/-, we decline into 10.20-11.00 Low (Speculative), rally to a 11.30H+/-, decline to a 1.10-15 pm Low. We see a last hour Low.

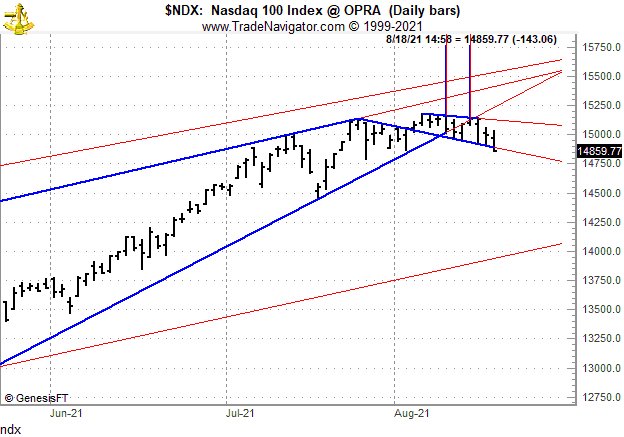

Apple, the NDX market leader, made fresh All time Highs and all Apple trends are higher. We are rallying into 12/9 & 12/13 CIT, suggesting a short term 12/10-13 High being made, but we need a reversal and close lower to confirm.

Bitcoin, the bubble leader, remains weak and closed lower Friday, below key pink channel support. We are declining into 12/13 Geometric time CIT, suggesting a short term Low.

* Notes: We use 2 proprietary Time CITs (Change in Trend) that are unique to our Raj T&C Daily Email newsletters.

1. Geometric time CITs are +/-1 Trading Day (TD) and are 70-80% accurate (20-30% will not work).

If we rally into a Geo time CIT, it suggests a High being made +/-1 trading day (TD).

If we decline into a Geo time CIT, it suggests a Low being made +/-1 trading day (TD).

2. Solar time CITs are +/- 1 TD and are 80-90% accurate (10-20% will not work).