http://safehaven.com/article/43358/raj-t-and-c-2016-year-in-review-and-forecasting-2017

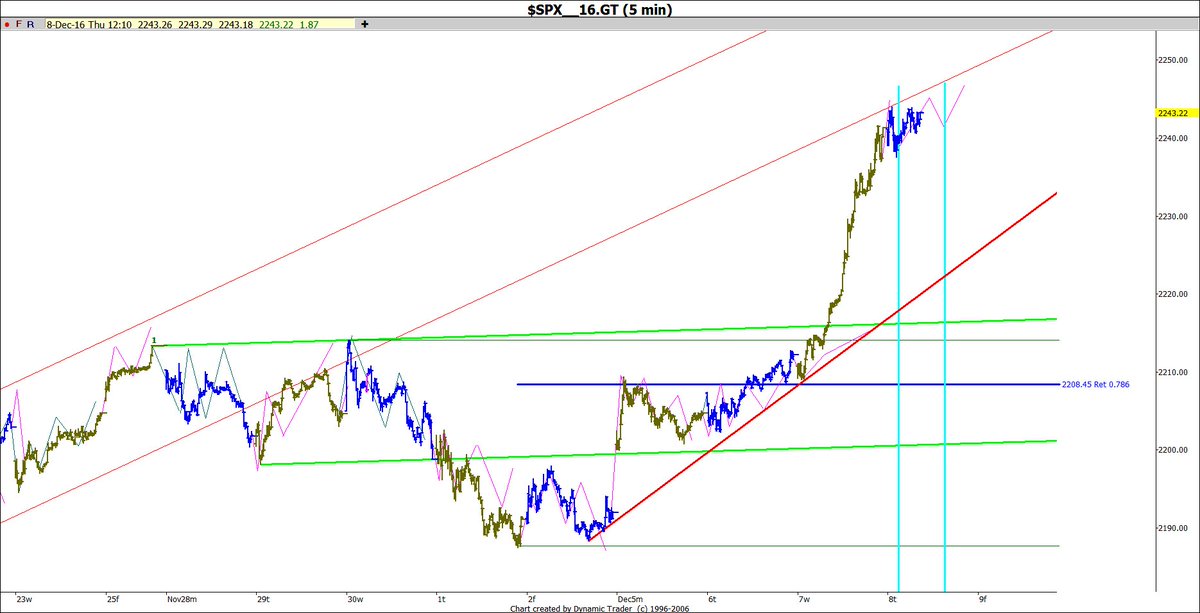

Forecast from my last 12/7 and 12/10 blog post, I was looking for a 12/8-9H and 2245 SPX as long term resistance: "The long term Geo CIT in CD arrives on Friday 12/9, along with the 12/9 Solar and Ezekiel Wheel CIT. It is allowed to be 1 TD off, so we could see a Monday higher 12/12 High"

What's next: We should decline into our 12/30-1/3 time CIT (Change in Trend) Low and start another rally into XXX major swing High.

Forecast from my last 12/7 and 12/10 blog post, I was looking for a 12/8-9H and 2245 SPX as long term resistance: "The long term Geo CIT in CD arrives on Friday 12/9, along with the 12/9 Solar and Ezekiel Wheel CIT. It is allowed to be 1 TD off, so we could see a Monday higher 12/12 High"

Actual: The actual High arrived only 2 TD later at the 12/13H, which remains the High to date, almost 3 weeks later. Price exceeded the long term trend line targets.

2016 Year in review

Many predictions were made in advance and posted on the Raj Time and Cycles public blog in 2016, some were misses, but many of them were direct hits and major High and Lows, within 0-2 days.

Below are some of the 2016 highlights, shown in the public links below:

1. The 1/20/16 Major Low was predicted by the Flash Crash cycle

2. The 2/11/16 major Low of the year was predicted by The February 2016 SPX Confluence with Crude Oil and Interest Rates.

3. The 6/27/16 major Low was predicted by the dominant cycle

4. The 9/07/16 major High was predicted by the 47 TD alternating High and Low cycle, the NDX 66 week cycle and the 41-42 week cycle.

5. The 11/04/16 major Low was predicted by the 47 TD alternating cycle and the 108 week cycle

Conclusion: The various Raj Time and Cycles techniques predicted 5-6 major Highs and Lows for 2016, within a day or so, including the 2/11/16 Low of the year. The 47 TD alternating Highs and Lows was prevalent in 2016.

After extensive research, we are filtering out a handful of the most important dates to watch in 2017 that shows a high degree of confluence and major Time and Cycles clustering. Won't it be useful to know these dates in advance? At least they have the potential to be tremendously profitable. 2017 should be a volatile year and fortunes can be made if the unique Timing and Cycles proves to be correct. It is best to be well prepared and make 2017 a Happy and prosperous New year.

Rajacar

Rajacar